August is National Make-A-Will Month. For many busy Americans, this yearly reminder is just the motivation they need to finally sit down and create their will or update an existing will.

Don Weden

Legacy Society memberUnderstanding Make a Will Month

Make a Will Month is aimed at raising awareness about the importance of having a will in place. It emphasizes the importance of estate planning to secure one’s legacy and ensure that personal assets are distributed according to one’s wishes.

The Importance of Having a Will

A will is more than just a legal document; it is a testament to your foresight and consideration for those you care about. Here’s why having a will is essential:

- Ensuring Your Wishes Are Honored: A will allows you to specify how your assets should be distributed among your beneficiaries (family, friends and charities).

- Providing Peace of Mind: Knowing that you have a legally binding document that outlines your wishes reduces the uncertainty and potential for disputes regarding asset distribution.

- Creating a Lasting Legacy: A will also allows you to leave instructions for sentimental items and charitable gifts to your favorite charities.

Already have a will?

Estate attorneys recommend reviewing your will every three to five years, or whenever you have a big life event (like getting married, moving states, or having a grandchild).

In August, consider taking 15 minutes to look over your will and make sure it’s up to date with your current preferences. Your life and relationships change over time — it’s important that your will reflects those changes, too.

Naming Beneficiaries

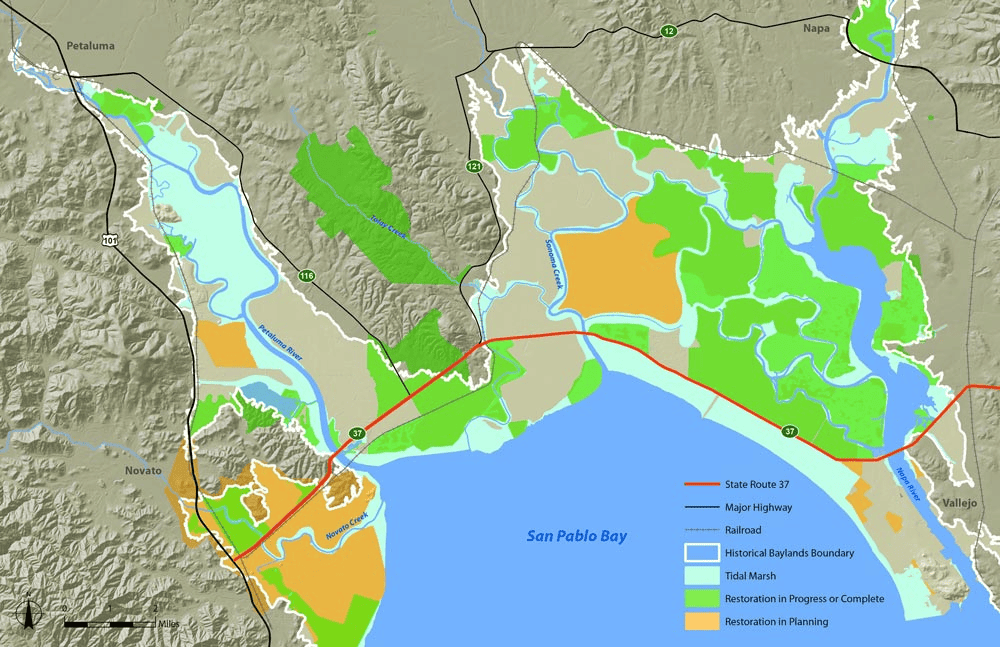

In addition to ensuring your family and friends are cared for in your estate plan, many people thoughtfully designate a gift to Save The Bay in their will, trust or other plans. A legacy gift will ensure San Francisco Bay is protected and restored for years to come.

If you are considering a legacy gift, we would be delighted to confidentially discuss your questions. If you have already included Save The Bay in your plan, please let us know so we can help ensure your goals are understood and your legacy gift will be used as you intended.

Please contact Masha Gutkin, Director of Individual Giving, via email or call (510) 463-6854. Of course, we always recommend you work with your advisors to determine which gift(s) is most appropriate for you.

EASY WAYS TO GIVE

Through a Will or Trust

Many people like to leave a gift to charity in their will making it the most common type of legacy gifts. You can arrange to leave Save The Bay a specific dollar amount or asset, a percentage of your estate, or the remainder after specific gifts to loved ones have been made.

Retirement Plans, Donor-Advised Fund or Other Accounts

You can name Save The Bay as the beneficiary of your individual retirement account (IRA), 401(k), 403(b), donor-advised fund (DAF), life insurance policy or other account. These gifts are easy to arrange or modify. Simply complete a beneficiary designation form from your plan administrator to name Save The Bay as a beneficiary of all or part of your account. If the retirement assets are tax-deferred, the portion left to Save The Bay will not be subject to tax.

If you arrange an IRA gift, thank you! To facilitate Save The Bay receiving your gift, please email or call (510) 463-6837 (or ensure your executor will do so) with your name, account custodian and contact information for your executor. IRA and other account administrators do not always notify the beneficiaries, and we want to make sure your gift for San Francisco Bay is received as you intended and in a timely manner.

Useful Information for Advisors

Organization Name: Save The Bay

Address: 560 14th Street #400, Oakland, CA 94612

Phone: (510) 463-6837

Taxpayer identification number: 94-6078420

Leaving a Lasting Impact

As you contemplate the importance of estate planning during Make a Will Month, consider the legacy you wish to leave behind. By including charitable organizations like Save The Bay in your estate plans, you can contribute to causes that are meaningful to you and help ensure a sustainable future for generations to come.